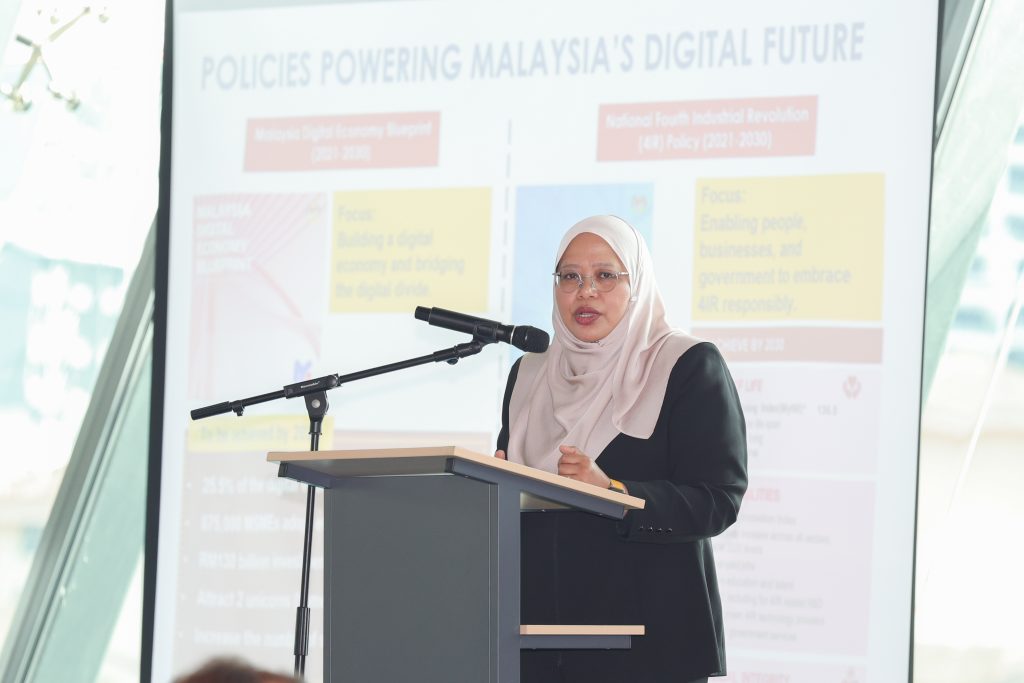

Keynote Presentation: Navigating What’s Next — Economic Outlook & Opportunities Beyond Budget 2026

Speaker

Puan Zalina Zainol

Deputy Chief Executive Officer (Investment Development), Malaysian Investment Development Authority (MIDA)

Key Discussion Points

- Six Decades of Transformation

Malaysia’s industrialisation began in the 1960s with bold policies—free trade zones, infrastructure investment, and human-capital development—that enabled diversification from rubber and tin into manufacturing and services. MIDA, founded in 1967, became the bridge between global investors and Malaysia’s growing industries. - A Shifting Global Landscape

The post-Cold War order is fragmenting. Global growth is forecast at ~3 per cent by 2026, while ASEAN’s average of 4.1 per cent signals regional resilience. Supply chains are being rebuilt for security and resilience; technology has become a geopolitical instrument. Malaysia’s open-trade model must stay agile to turn disruption into opportunity. - Malaysia’s Strategic Readiness

Budget 2026 operationalises major national frameworks—the New Industrial Master Plan 2030 (NIMP 2030), National Energy Transition Roadmap (NETR), and 13th Malaysia Plan—anchored on three growth engines:- Semiconductors

- Energy Transition

- Digital Economy

- Semiconductors — Driving High-Value Manufacturing

- Contributes nearly ⅓ of manufacturing GDP and ~40% of exports.

- The National Semiconductor Strategy (NSS) targets RM500 billion investments by 2030 to elevate Malaysia from back-end manufacturing to design, R&D and IP creation.

- First-year momentum: RM 54.2 billion new investments, backed by Budget 2026 allocations—RM 180 million for R&D, extended design-incentives, and talent programmes.

- Landmark expansions include Infineon’s SiC plant, Carsem’s AI-enabled packaging, and advanced electronics by NXP, Syntiant, and Plexus.

- Energy Transition — Building a Sustainable Green Economy

- Net-zero GHG by 2050; 45% reduction by 2030.

- NETR identifies 10 flagship projects in renewables, hydrogen, green mobility and CCUS.

- Budget 2026 introduces a carbon tax, 100% Green Investment Tax Allowance, and accelerated capital allowances for green assets.

- MIDA has approved 1,708 green projects worth RM 25.3 billion—half locally funded—with solar, biomass, and BESS at the forefront.

- Through the Green Investment Strategy, Malaysia targets RM 305 billion by 2030.

- Partnerships like the MIDA–JETRO MoC (Expo 2025 Osaka) have secured RM 11–12 billion in Japanese-led renewable and semiconductor investments.

- Digital Economy — Malaysia as ASEAN’s Digital Gateway

- RM 235 billion in data-centre investments (2021–Jun 2025) by global players such as Oracle and ByteDance.

- Budget 2026 commits:

• RM 2 billion for a Sovereign AI Cloud to safeguard national data;

• RM 5.9 billion for R&D and innovation;

• RM 53 million for the Digital Acceleration Grant. - Malaysia adopts a whole-of-value-chain approach requiring co-investment in renewable energy and local supply chains.

- Venture-capital incentives—5% tax for VCCs, 10% for VC Managers, and tax-free dividends—aim to deepen tech financing.

- Talent initiatives such as MyMahir Future Skills, MyDigitalMaker, and Premier Digital Tech Institutions underpin a digitally fluent workforce.

- MIDA’s Execution Role — From Plans to Progress

- 20 global offices and 12 state branches provide end-to-end support.

- Invest Malaysia Facilitation Centres (IMFC & IMFC-J) streamline multi-agency approvals.

- The National Investment Incentive Framework (NIIF) introduces outcome-based incentives tied to technology transfer, job creation, and sustainability.

- First-half 2025: RM 190.3 billion approved investments (+RM 22.5 billion pipeline) signal investor confidence.

- Strengthening Local Supply Chains

- Vendor Development and Supply Chain Programmes connect MNCs with Malaysian SMEs.

- 2025 conferences featured 35 anchor firms (e.g. Infineon, TI, ByteDance) and 300 suppliers—producing tangible linkages across E&E, automotive, and data centre value chains.

- Talent Pipeline & Industry 4.0 Readiness

- Over 13,000 high-skilled workers trained in semiconductors.

- Flagship programmes:

• Embedded Software Talent Programme (EEPN);

• UiTM Work-Based Learning with TF-AMD, Samsung SDI, Stellantis, Nexperia;

• Nationwide STEM outreach to 58 schools. - Industry4WRD and Digital Transformation Programme help SMEs adopt automation and robotics through grants, training, and the Investment Coordination Platform.

Key Takeaways

- Malaysia’s next growth phase is anchored on semiconductors, green transition, and digital economy, underpinned by Budget 2026 allocations.

- MIDA’s mission extends beyond investment promotion to execution — through facilitation centres, outcome-based incentives, and supply-chain development.

- Sustained policy clarity, talent depth, and green-digital linkages will define Malaysia’s competitiveness in a fragmented global economy.

- The foundation is set for Malaysia to be a trusted regional hub for technology, sustainability, and innovation — turning Budget 2026 from plan to performance.

Panel Session 1: E&E Enhancing Competitiveness and Resilience in the Global Supply/Demand Chain

Moderator

Encik Jaffri Ibrahim

Chief Executive Officer, Collaborative Research in Engineering, Science & Technology (CREST)

Panelists

Dato’ Seri Wong Siew Hai

President, Malaysia Semiconductor Industry Association (MSIA)

Ts. Norhizam Ibrahim

Executive Director (Manufacturing Development) & Chief Digital Officer, Malaysian Investment Development Authority (MIDA)

Mr. Ramesh Kumar Verma

Director, Investment, Northern Corridor Implementation Authority (NCIA)

Key Discussion Points

- E&E remains Malaysia’s growth engine

E&E accounts for ~40% of exports, with strong momentum in 2025 driven by AI infrastructure, 5G devices, EVs, and advanced medtech. The ecosystem depth—not just volumes—underpins resilience. - From FDI-led growth to Malaysian champions

Multi-billion expansions (Intel, Infineon, AT&S, TI, etc.) validate Malaysia’s base. The next step is converting FDI into local capability: equipment/automation, IC design services progressing to own IP, and selective moves toward front-end adjacencies. - MSIA’s role and industry realities (Wong)

- MSIA (≈230 members) focuses on R&D, ecosystem strengthening, global competitiveness, and being the sector’s collective voice.

- Climbing the value chain is capital- and customer-intensive: IC design can require ~US$100M+; OSAT hundreds of millions; fabs into the billions. Market access is the choke point—first customers de-risk everything.

- Policy agility and impact-based incentives

- Historic “product-based” incentives are being replaced by a national, outcome-based framework that rewards spillovers: supply-chain linkages, technology depth, inclusivity/LDA siting, and local capability building.

- Malaysia’s model depends on MNC–local collaboration; keeping existing projects while adding new ones is vital (“once lost, hard to regain”).

- Government programmes are seeding higher-end local plays (IC/IP, advanced packaging), but commercialisation needs mentoring, financing, and early offtake.

- Northern Corridor as the nucleus

- NCER hosts the majority of semi players and workforce, acting as a base from IC design through OSAT to commercialisation.

- Planned Advanced Packaging Institute/Business Centre aims to close gaps from design to prototyping/small-scale production (fan-in/fan-out, 2.5D/3D stacking, wafer/panel-level packaging), lifting OSAT revenues and enabling cross-sector spillovers (aerospace, medtech, EV).

- Persistent focus on talent pipelines (e.g., ANTIC) and high-impact incentives to catalyse investment in less-developed areas.

- Audience challenge: why haven’t we moved faster?

In response to criticism that firms remain stuck in low-cost manufacturing, the panel pointed to:- High capital thresholds and chicken-and-egg issues (customer + technology access).

- Need for risk-sharing finance and anchor demand from in-country MNCs (e.g., “localise one EV IC” as a start).

- Government support evolving toward coordinated execution across agencies and outcome-based incentives.

- Talent is the swing factor

Scaling advanced packaging, design enablement, and high-reliability manufacturing requires sustained upskilling and placement—especially for mid-tier grads—through corridor programmes and industry-linked training.

Key Takeaways

- Keep the base, climb the curve. Safeguard OSAT/test strengths while building advanced packaging, IC design, and equipment champions.

- Anchor demand unlocks funding. Localisation commitments from MNCs (first customers) de-risk Malaysian IP/products and crowd in capital.

- Incentives by impact, not SKUs. The new framework prioritises spillovers, inclusivity, and supply-chain depth over legacy product lists.

- NCER as catalyst. Advanced Packaging Institute and talent programmes aim to complete the value chain and spread benefits beyond Penang/Kedah.

- Talent pipelines decide speed. Practical training and job placement must keep pace with investment to shift from “made in” to “made by Malaysia.”

Panel Session 2: Energy Transition: Accelerating Towards Achieving a Sustainable and Inclusive Energy Ecosystem

Moderator

Mohd Fauzi bin Mustafa

Deputy Director, Energy Division, Ministry of Economy

Panelists

Mr. Mohd Rizal Ramli

Senior Deputy Director, Energy Commission (Suruhanjaya Tenaga)

Ir. Mohd Zamri Laton

Deputy Director (Senior Market Operation), Sustainable Energy Development Authority (SEDA)

Ir. Justin Sim

President, Malaysian Photovoltaic and Sustainable Energy Industry Association (MPSEA)

Key Discussion Points

- Malaysia’s Net-Zero Commitment

The moderator reaffirmed that the NETR charts Malaysia’s pathway to 70% renewable electricity generation by 2050. Energy transition is now a core pillar of national economic growth, requiring coordinated action across regulators, industry, and financiers. - Energy Commission’s (ST) Role and the Future of Energy Storage

Mr. Mohd Rizal outlined ST’s regulatory scope—overseeing electricity and gas supply under three main Acts (Electricity Supply Act, Gas Supply Act, and Energy Commission Act). ST manages tariff setting, grid codes, licensing, and major RE programmes such as Large-Scale Solar (LSS), MyBESS, and Corporate Green Power Programme (CGPP).- As Malaysia’s solar capacity grows (5.5 GW currently, expected to surpass 10 GW soon), BESS becomes vital to manage intermittency and flatten the “duck curve.”

- Storage solutions—lithium-ion batteries, pumped hydro, compressed air, and other technologies—will be central to balancing supply after sunset and ensuring grid reliability.

- ST projects Malaysia will reach its 2035 solar target earlier than planned, necessitating early integration of large-scale storage systems.

- SEDA’s Programmes and the Launch of FIT 2.0

Ir. Mohd Zamri shared that SEDA, established in 2011, continues to promote sustainable energy under three pillars: Renewable Energy, Energy Efficiency, and Human Capital Development.- The agency manages the Feed-in Tariff (FiT) and Net Energy Metering (NEM) programmes, which have driven Malaysia’s RE adoption for over a decade.

- The newly announced Feed-in Tariff 2.0 (FiT 2.0) introduces 300 MW of quota—comprising 50 MW (biogas), 150 MW (biomass), and 100 MW (hydro/solar hybrid)—with applications opening 10 February to 17 March 2026.

- FiT 2.0 adopts a two-tier tariff model: maximum base tariff for the first 10 years (e.g., biogas at 45 sen/kWh, biomass at 45.9 sen/kWh, hydro at 35 sen/kWh), followed by competitive bidding thereafter.

- Developers are expected to secure strong financial backing, creating natural partnerships with financiers and institutions such as MDV to bridge capital requirements.

- Industry Perspective: MPIA’s Call for Policy Stability and Manpower Growth

Ir. Justin Sim highlighted MPIA’s expanded mandate as the Malaysian Photovoltaic and Sustainable Energy Industry Association, now representing over 300 members across developers, financiers, and technology partners.- MPIA’s priorities include policy advocacy, talent development, and public awareness.

- The association noted that manpower shortages, especially in technical engineering for solar and battery integration, remain a bottleneck. Most talent currently leans toward sales rather than system design and implementation.

- MPIA urged the government to ensure smoother policy continuity between NEM and emerging schemes, noting that quotas for NEM 2.0 and 3.0 were rapidly exhausted.

- The new 500 MW allocation announced under Budget 2026 should be distributed inclusively—benefiting both major corporations and SMEs—to avoid crowding-out effects.

- MPIA also called for certification and training standards for engineers working on BESS and hybrid solar systems to ensure safe, quality deployment.

- Macro Perspective: Decarbonisation Across Sectors

Concluding the session, the moderator emphasised that energy transition is only one part of Malaysia’s net-zero equation. Decarbonisation efforts must also extend to transport, industry (steel, cement, power), and aviation—through sustainable fuels, bioenergy, hydrogen, and CCUS (Carbon Capture, Utilisation & Storage).

These levers—energy efficiency, renewable energy, clean mobility, bioenergy, hydrogen, and CCUS—form the backbone of Malaysia’s multi-sector strategy under NETR.

Key Takeaways

- Energy storage is essential to sustain Malaysia’s high solar penetration; BESS and other storage technologies will stabilise grid demand beyond 2035.

- FiT 2.0 revives investor confidence in renewable energy by introducing structured, bankable tariffs and competitive bidding mechanisms.

- Policy consistency and inclusivity are critical — small and medium developers must have equitable access to RE quotas and financing.

- Technical manpower and certification frameworks for solar-battery integration are urgently needed to support large-scale rollout.

- Cross-sector decarbonisation—spanning energy, transport, and heavy industry—will define Malaysia’s pathway to net zero by 2050.

Breakout Session 1: Bridging the Expectation Gap: Aligning Funders and Start-Ups For Success

Moderator

Mohd Farid Mohd Rosli

Vice President, Malaysia Debt Ventures (MDV)

Panelists

Norman Matthieu Vanhaecke

Group CEO, Cradle Fund Sdn. Bhd.

Elain Lockman

Co-founder & CEO, Ata Plus

Ng Sai Kit

Chairman, Malaysian Venture Capital & Private Equity Association (MVCA)

Key Discussion Points

- Cradle’s Perspective – Quality over Quantity (Norman Vanhaecke)

- Cradle offers early-stage grants (CIP Spark and CIP Sprint) focused on ideation and early commercialisation.

- A rigorous due diligence process ensures that only deserving startups are funded, including screening, evaluation, site visits, and board approvals with external experts.

- Success metrics remain strong: >75% commercialisation rate and >50% survivability rate for funded startups.

- Grants are not automatic entitlements—founders must demonstrate accountability as funds are public money.

- Cradle also builds bridges for startups through Angel University and MyStartup platform, connecting 4,500 startups with local and ASEAN market access.

- ECF Realities and Founder Mindset

- Ata Plus, a licensed equity crowdfunding (ECF) platform, enables startups to raise capital from the public, but the process mirrors IPO-level governance.

- Many founders initially underestimate the compliance required—rigorous validation of business models, projections, and assumptions are mandatory.

- Fundraising requires discipline: transparent documentation, proper financial reporting, and consistent communication post-funding.

- Only around 19,000 retail investors have participated in ECF nationwide since 2016, highlighting low financial literacy but strong untapped potential.

- Co-investment funds like MyCIF (by SC) and MDV’s co-investment facility now amplify ECF’s reach, but businesses must treat this as investment, not aid.

- Investor–Founder Misalignment

- Two core tensions persist:

a) Valuation vs. Value Creation — founders fixate on valuation while investors emphasize scalability and returns.

b) Transaction vs. Relationship — founders often view fundraising as a one-off deal, whereas investors seek long-term partnership and transparency. - Building trust before investment discussions is critical. The best deals arise from continuous relationships, not cold transactions.

- Mental health pressures among founders are increasingly common; investors should play a supportive, not adversarial, role.

- Exit strategies (trade sale, IPO, or strategic acquisition) must be discussed early and revisited regularly to maintain alignment.

- Two core tensions persist:

- Public vs. Private Capital – Perception vs. Reality

- Many founders wrongly assume government funds are “easier to get.”

- In reality, agencies like Cradle face stricter governance layers and legal due diligence than private VCs.

- Private funds are faster but expect equity returns; government funds are slower but come with ecosystem-building mandates.

- Founders should understand both serve complementary—not competing—roles in the funding landscape.

- Governance and Compliance – Non-Negotiable

- Reporting and transparency remain the weakest points among local startups.

- Annual updates and audited accounts are minimal expectations, not bureaucratic hurdles.

- Failures are acceptable; dishonesty isn’t. Breach of fiduciary duty has led to legal action, as shared by the moderator.

- Communication and mutual respect are essential—investors can be friendly, but governance must be firm.

Key Takeaways

- Funding is a privilege, not an entitlement. Start-ups must respect public and private investors’ trust through full transparency.

- Malaysia’s support ecosystem is strong—grants, ECF, co-investment funds, and angel programmes—but founders must raise their own governance and reporting standards.

- Valuation follows value. Sustainable relationships with investors matter more than quick capital.

- Compliance builds credibility. Proper documentation, reporting, and openness attract more long-term capital.

- Collaboration, not competition, between public and private funds will determine the maturity of Malaysia’s start-up ecosystem.

Breakout Session 2: ICT & Connectivity – Leveraging Digital Infrastructure in the Everchanging and Dynamic Economy

Moderator

Zuhry Rashid

Vice President, Research & Technology Advisory, Malaysia Debt Ventures (MDV)

Panelists

- A. Hadie Zakaria, Head of Commercial, Technology Infrastructure and Security Management, CelcomDigi

- Hadzry Rajab, Account Director – Malaysia Enterprise Business Dept, Huawei Malaysia

- Abdul Halim Lassim, Treasurer, PIKOM

Key Discussion Points

- Expanding Digital Connectivity and Inclusion

The session highlighted the importance of digital infrastructure as the backbone of Malaysia’s economic transformation. The nationwide 5G rollout under JENDELA and the MyDIGITAL Blueprint is critical to ensuring that digitalisation benefits all layers of society.

Beyond urban enterprises, the government and industry are expanding connectivity to SMEs and underserved communities. The success of the Pusat Ekonomi Digital (PEDi), formerly known as Pusat Internet Komuniti (PIK), demonstrates how focused initiatives can bridge the digital divide and empower rural communities through digital access, entrepreneurship, and online learning. - Collaborative Investment for Sustainable Infrastructure

Building a robust and inclusive digital backbone requires innovative public–private partnerships. Telcos, technology providers, and the government must work together to address high infrastructure costs while ensuring broad coverage and sustainable investment models. - Technology Innovation and Sustainability

Huawei Malaysia emphasised that with the growing demand for AI, IoT, and cloud computing, Malaysia must prioritise energy-efficient and sustainable data centres. Integrating global expertise with local innovation will strengthen the nation’s ICT resilience and sustainability. - Cybersecurity and Data Governance

The discussion underscored that cybersecurity and data integrity are vital in Malaysia’s digital evolution. Establishing a trusted and interoperable ICT framework is essential to ensuring confidence, resilience, and effective collaboration among public and private stakeholders. - Policy Advocacy and Regulatory Agility

PIKOM called for greater regulatory agility to overcome challenges such as spectrum allocation delays and cross-border connectivity issues. Supportive, forward-looking policies are key to keeping Malaysia competitive in the regional digital economy.

- Talent Readiness

Malaysia’s digital talent pool is ready to drive national transformation, supported by language proficiency, adaptability, and technical skills. Continuous upskilling programmes and industry–academia collaboration will ensure the workforce remains competitive and capable of leading regional innovation.

Key Takeaways

- Malaysia’s 5G rollout under JENDELA and the MyDIGITAL Blueprint is a catalyst for national digital competitiveness and inclusion.

- Public–private collaboration is vital to financing and sustaining nationwide digital infrastructure.

- Malaysia must continue promoting sustainable ICT growth through energy-efficient data centres and green digital technologies.

- Cybersecurity and data governance are key to building trust and protecting national digital infrastructure.

- Agile regulatory frameworks are needed to facilitate innovation and ensure Malaysia’s continued regional competitiveness.

- The country’s talent pool—with strengths in language, adaptability, and technical capability—is well-positioned to drive the next phase of digital transformation.

- Ongoing ecosystem collaboration between industry and government will be crucial to building a future-ready and inclusive digital economy.